Sep 27, 2025 · Discover how to determine asset value using absolute valuation methods. Learn about discounted cash flow models, comparables, and more with practical examples and insights. Sep 27, 2025 · Discover how to determine asset value using absolute valuation methods. Learn about discounted cash flow models, comparables, and more with practical examples and insights. Asset valuation is the process of determining an asset 's worth or financial value. It involves assessing various factors such as market conditions, demand and supply dynamics, comparable sales, income generation potential, and intrinsic characteristics of the asset . Asset valuation is the process of determining an asset 's worth or financial value. It involves assessing various factors such as market conditions, demand and supply dynamics, comparable sales, income generation potential, and intrinsic characteristics of the asset . What is asset valuation and why is it important? How to value an asset based on the prices of similar or comparable assets in the market? How to value an asset based on the present value of its future cash flows or earnings? How to value an asset based on the cost of reproducing or replacing it? How to combine different valuation methods to get a more accurate or robust estimate ... What is asset valuation and why is it important? How to value an asset based on the prices of similar or comparable assets in the market?

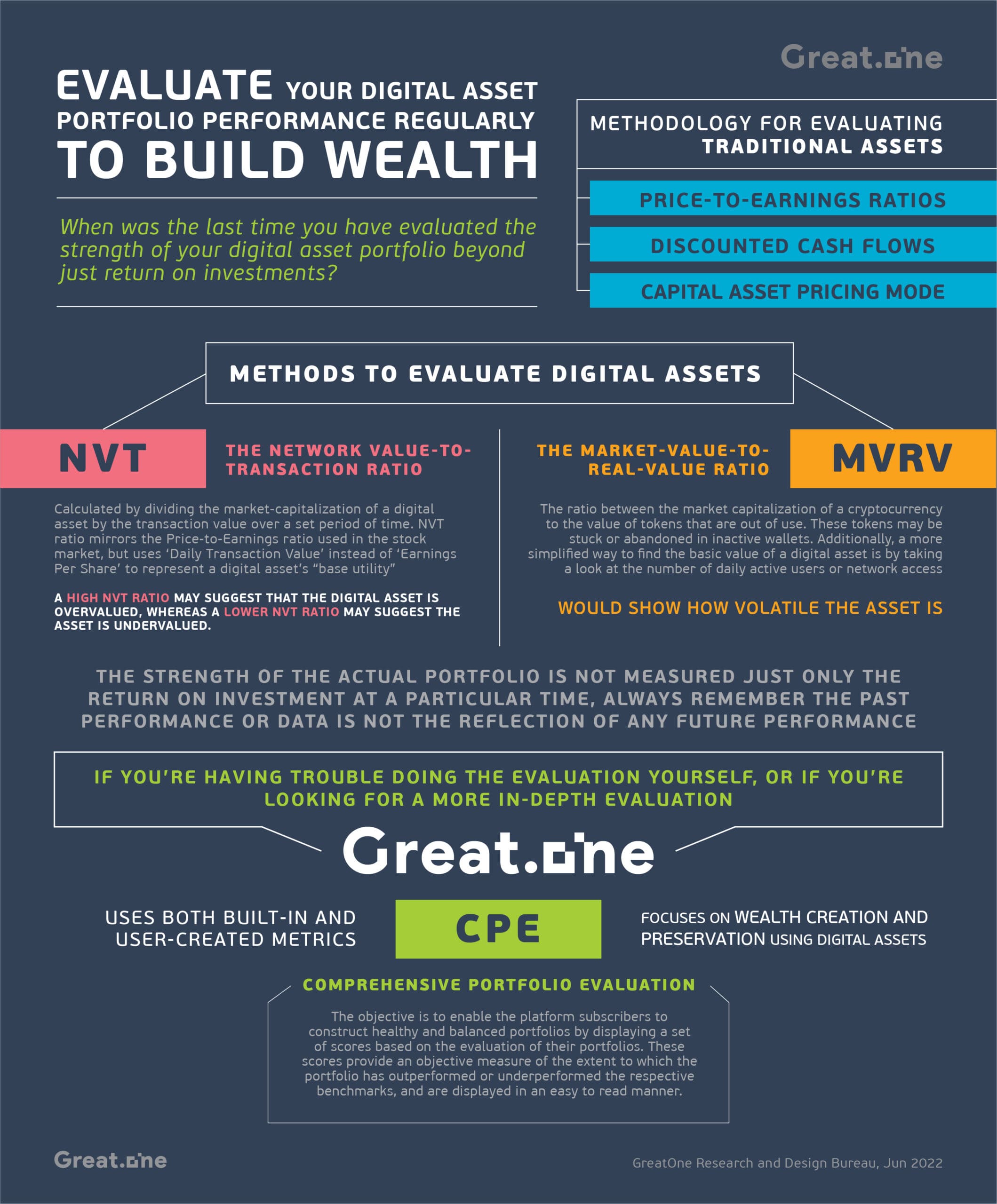

Asset Valuation In Blockchain Projects

The Fundamentals Of Asset Valuation Explained

Asset Evaluation For Venture Capital Investments